Share

0

/5

(

0

)

Over the years, the trading world has been changing, with modern digital technologies significantly impacting financial markets, transforming the role of brokers in the FX market. Forex brokers have moved online, offering easy currency trades and profits to average and expert traders. However, with this digital transformation comes a new set of challenges. In this article, we will discuss Forex brokers' main concerns in the new digitalised era and elaborate on how to solve them.

Key Takeaways

The broker is authorised to trade stocks and other assets in the market.

Brokerages provide access to trading venues for market participants.

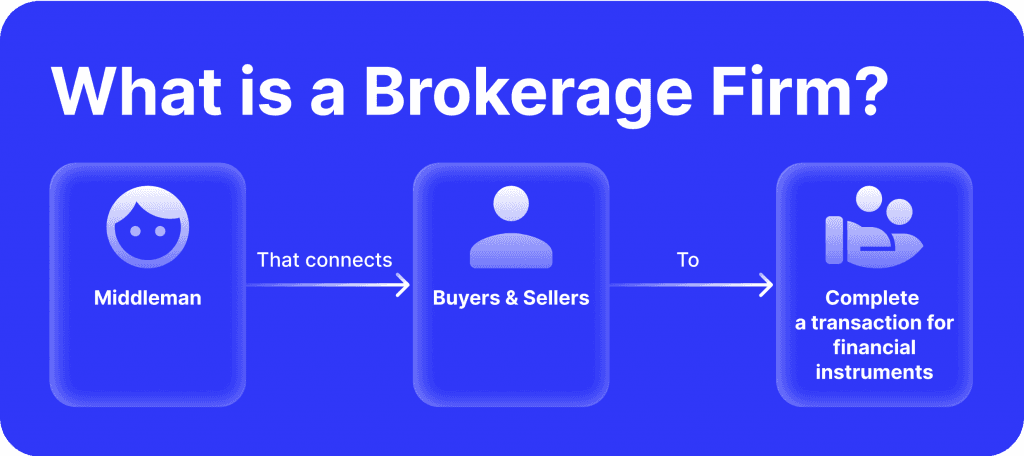

A brokerage firm acts as an intermediary between buyers and sellers.

Brokers face concerns such as compliance with regulations, building reliable infrastructure, adapting trading technologies, acquiring financial expertise, etc.

What Is Brokerage And How It Works

A broker is a person or company authorised to buy and sell stocks or other investments.

A brokerage firm's primary role is to provide access to trading venues, such as NYSE or NASDAQ exchanges or other platforms, where market participants trade securities. Exchanges like the NYSE or NASDAQ act as a supermarket for stocks, connecting buyers and sellers, imposing rules, and tracking demand, influencing the stock's price.

However, the average investor cannot simply buy stock from an exchange; they need to open a brokerage account and use a broker to buy or sell stocks or other securities. Brokerage clients can place orders through their broker, either through an online trading platform or by speaking directly with their broker or representative. Brokers find the most suitable venue for the trade, such as a stock sale or OTC execution, to facilitate the trade for the client at the best possible price.

[aa quote-global]

Fast Fact

The total number of Forex traders worldwide is approximately 10 million.

[/aa]

To be able to advise which stocks to buy and sell, brokers must be registered with the U.S. Securities and Exchange Commission. However, they should not be confused with financial planners who offer more comprehensive financial guidance.

Simply put, a brokerage is an intermediary that connects sellers and buyers to facilitate transactions in various areas such as investing, loan obtaining, and real estate purchasing. Brokers, either individuals or legal entities, perform transactions according to client instructions and are compensated with either a flat fee or a specific percentage of the transaction amount.

A broker's primary function is to solve client's problems for a fee. They can execute trades on financial markets, provide information support on trading platforms, make informed decisions about market participants, lend for margin transactions, store and protect customer data, and create a technical base for exchange transactions.

Common Problems Brokers Might Face

Broker companies also perform broader activities beyond mediation, meaning the financial market would not exist without them. Despite being crucial players in the market, brokers are grappling with numerous challenges that can be daunting. However, they learn to overcome them to maintain profitability and competitiveness.

Here are some of the most common concerns brokers may encounter and possible solutions to them.

1. Regulations

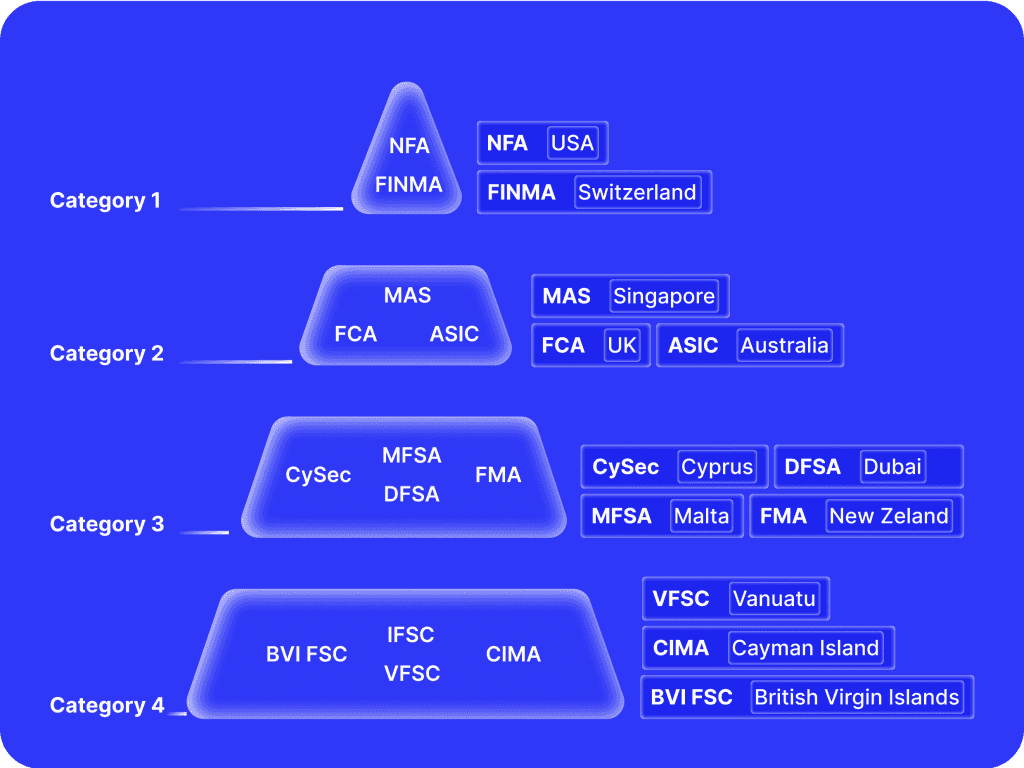

Forex brokerages operate globally with partners and clients under various regulatory jurisdictions. Compliance needs have increased over the past decade as international regulations become more complex. Brokers must report to regulatory bodies as it is required to ensure the brokers' operations comply with all the applicable rules and laws.

The increasingly strict regulations imposed by regulatory bodies like FCA, ESMA, and ASIC have made it difficult for average retail customers to engage in leveraged trading due to the high-risk nature.

Retail FX brokers face a constant challenge in regulatory updates and amendments, which can come from various sources such as the European Securities and Markets Authority, trade repositories, national competent authorities, and approved reporting mechanisms.

Solution

To address this concern, brokers can move offshore, work with global partners, or meet their country's regulations requirements. It is mandatory to keep compliance documents and records with regulatory authorities.

Forex brokers can also use software or back-office tools to manage documents and ensure compliance with the law.

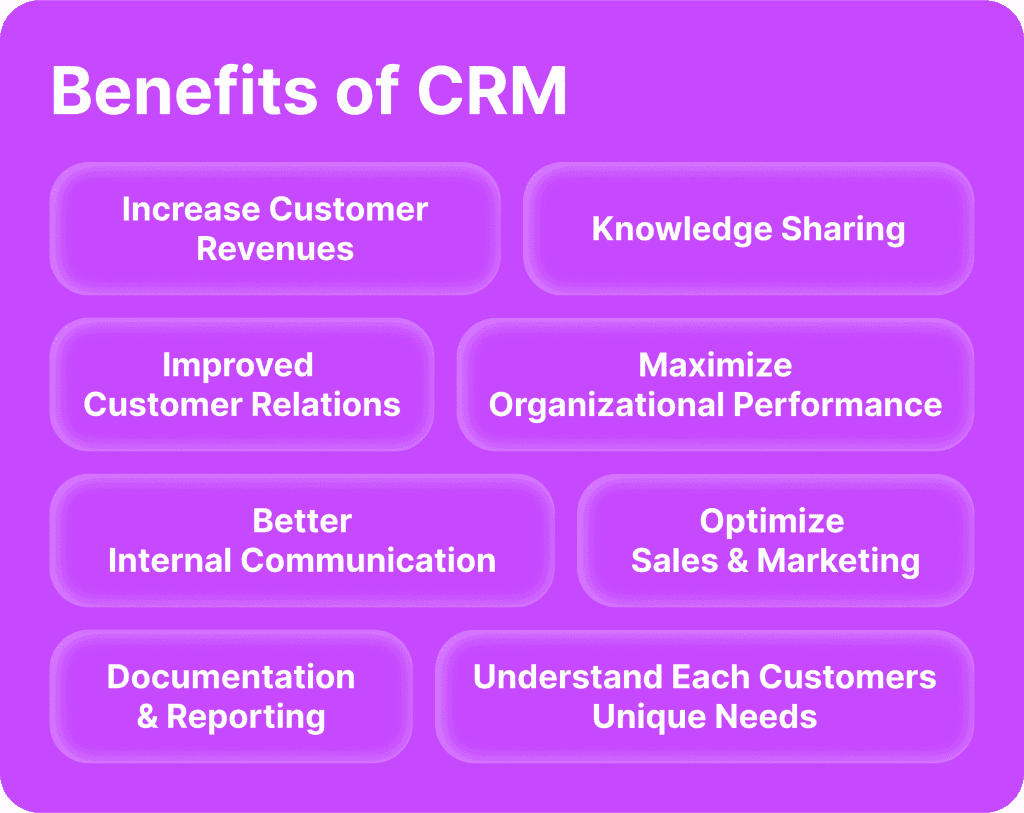

The CRM is a user-friendly tool that simplifies navigation through stored documentation and records and allows for generating custom reports that can be automated once parameters and requirements are set, reducing the reporting burden.

2. Infrastructure

Advancing your brokerage house requires robust infrastructure, but trading firms are not tech providers. Maintaining this infrastructure, including networks, servers, IT departments, and software, requires significant resources, time, and expertise. Growing firms may find the back office overwhelming, and many resellers need more substantial infrastructure to support their clients.

FX brokers need advanced technology for online trading and back-office support. They should automate processes like KYC, lead management, and IB management to save time and streamline operations.

Solution

A well-designed CRM can help brokers streamline these tasks, ensuring effective online trading. Outsourcing CRMs is a solution for complex systems that require a dedicated, specialist team. Outsourcing should cover all aspects of CRM, including KYC, client profiles, automatic reporting, and client communications. Choosing a technology provider is essential since it is necessary to ensure data safety and avoid losing important information. Brokers can customise the Forex CRM to meet their needs and integrate all required modules.

For instance, B2Core is a leading CRM solution for FX brokers and crypto exchanges, handling daily tasks such as organisation, back office, front-end, customer verification, and payment functions. B2Core offers an adaptive dashboard for users to access their activities, real-time financial data, and trading activity analysis. The features include:

An adaptive dashboard.

Easy KYC account verification procedures.

A user-friendly UI interface.

The platform's capabilities include adding, replacing, and deleting widgets, providing real-time financial data, analysing trading activity, and facilitating KYC account verification.

3. Marketing

The Forex industry is highly competitive, presenting challenges for business growth. To succeed, businesses must actively market their services to a broader audience, often through traditional means.

With $5.3 trillion in daily trades, the Forex market is one of the largest industries where leading brokers dominate, leaving new and start-up brokers in a smaller market. To succeed, traders must stand out with unique features and exceptional customer service, gaining their clients' trust.

Solution

Many FX trading CRMs provide valuable technology tools for marketing and sales departments, such as in-depth statistics on traders' actions and products they request. This helps understand the benefits offered to brokers and how to leverage them in marketing efforts.

However, some traditional methods can also work for advertising brokers' businesses. This includes attending conferences or maintaining an active social media presence.

Search engine optimisation (SEO) can also be very helpful in bringing brokerages to a broader audience. SEO refers to how efficiently popular search engines can rank a site. A higher ranking in organic search results is achieved by creating original, exciting content linking to relevant external sites and articles or pages within a broker's site. Link building is another way to work with SEO, where another industry-relevant site links to the broker's site through its content.

Forex brokers should utilise digital advertising, SEO, blog posts, informative webinars, up-to-date sales techniques, and social media platforms to increase conversion rates, gain industry ranking, and showcase their presence in the competitive market.

4. Retaining Clients

Despite improvements in regulations and firms taking their duties seriously, the trading industry has a questionable reputation due to license issues and operating in suspicious jurisdictions. The FX trading space is fiercely competitive, with companies offering challenges, incentives, and deals to attract traders. Brokerages must be careful to retain existing clients while reaching out to potential leads to maintain their reputation.

Solution

A solid solution that addresses clients' needs is crucial for attracting and satisfying new businesses. Many studies show that finding new clients is more expensive than retaining existing ones, and long-term loyalty is more valuable. Brokerages can expand their customer base and attract more clients by first they need to focus on keeping clients.

There are multiple ways to retain clients. Thus, brokerages can deliver a personalised experience to their clients. They can utilise customer data for a comprehensive understanding of trader preferences, such as currency, trading times, and platform, enabling content tailoring to each trader, thereby enhancing customer experience.

Predictive behaviour modelling can help identify VIP traders early in their customer journey, increasing customer loyalty and driving revenue growth. It also helps in strategic decisions on where to focus FX marketing efforts based on individual customers' expected trading behaviour.

5. Financial Expertise

Brokers face challenges if they lack knowledge of the FX market, as they must guide traders through proper market analysis, seminars, and webinars, which require thorough knowledge.

To succeed in the financial markets, brokers must possess extensive knowledge and demonstrate their professionalism. Brokers should show their financial expertise and ability to work markets while teaching and coaching traders about online trading.

Solution

Continuous learning is crucial in any market, and brokers should develop strategies to help traders win the market through continuous market analysis.

Initiating quality learning exchanges through webinars, e-books, articles, and videos about actual financial trading could be an excellent solution to demonstrate a broker's expertise to their clients. Using knowledge as a resource aims to turn traders into professional investors equipped with accurate trading information and authentically positioned to succeed.

6. Technology

Though most brokers currently have limited technology for trading, they must transition from manual operations to technology to remain competitive and comply with regulatory guidelines. Technology enhances efficiency in broker trading through trading platforms, which are software applications that allow traders to execute trades, view real-time market data, and manage their accounts.

Solution

Brokers should seek advanced trading platforms that offer instruments like charting tools, technical indicators, and oscillators to help traders analyse historical price data, identify trends, make informed decisions and improve workflow efficiency. These advanced platforms should also provide customisable alerts and notifications to keep traders updated on market movements and essential events.

Algorithmic trading systems, or trading robots, are crucial for forex trading. With high speed and accuracy, these systems execute trades based on pre-programmed instructions, such as price levels, technical indicators, or news events, thereby eliminating the risk of human errors. Algorithmic trading systems provide efficiency and accuracy by executing trades faster than manual trading, processing vast amounts of data and executing them within milliseconds. This speed is crucial in fast-paced markets like forex, where even a slight delay can lead to missed opportunities or unfavourable price movements.

7. Broker's Reputation

Unfortunately, not all Forex brokers are honest, and scam brokers can cause problems for clients, including aggressive slippage, artificial market spikes, and stealing deposit or profit funds. This may also affect responsible and trustworthy brokerages since such unethical behaviour casts a shadow on the whole trading industry, establishing a questionable reputation for it both among novice traders and those already in the industry.

Solution

To build a successful business and ensure its financial wellness, working with reputable partners, such as payment service providers, banks, and money managers, and investing in industry-leading tools is essential. This will help build trust with clients and ensure the firm's reputation as a serious player in the industry. Additionally, it can be helpful to post on social media, leaving contact details prominently and avoiding ridiculous claims in marketing material. Also, brokers should collaborate with clients to produce exciting content and address their problems and needs.

Conclusion

Shifting to an online brokerage has brought many benefits; however, there are some common challenges that today's brokers have to solve to keep their businesses successful, retain clients and attract new customers. Today, brokers have to deal with ever-changing regulations and ever-evolving technologies, keep up with market news, expand their knowledge and expertise and maintain their reputation in the industry. FX trading CRMs come to help brokers overcome these concerns. Such solutions can be especially advantageous for those starting a new business in the financial sphere.

FAQ

How much money do I need to start a brokerage firm?

Starting a brokerage firm requires substantial investment, including licensing fees, technology infrastructure, operational costs, etc. The required expenses can reach several million dollars, depending on scale and location.

How Do Brokers Work?

A broker is an intermediary who facilitates transactions between traders, acting as a middleman to ensure smooth transactions and the necessary information is provided to each party. Brokers can work in various sectors like the insurance sector, real estate, finance, and trade.

Why is it difficult to trade on Forex?

The FX market is influenced by various factors, such as economic indicators, political events, and natural disasters, which can cause sudden price movements, making it challenging for traders to predict market direction.

Read also